Present Value of an Annuity: Meaning, Formula, and Example

For all types of annuities, earnings are not taxable until the money is withdrawn. Because withdrawals are taxed on a “last in, first out” (LIFO) basis for a non-qualified annuity purchased after Aug. 13, 1982, earnings are paid out before principal. Deferred Distributions—Another nice perk of annuities is their tax-deferred status. With other popular retirement investments, such as CDs, you’ll have to pay Uncle Sam when they reach the maturity date. With annuities, though, you don’t owe a penny to the government until you withdraw the funds.

Two Types of Annuities

So, if you chose a 10-year guarantee period and died after 5 years. Your annuity income will continue to be paid to your named beneficiary or estate for a further 5 years after your death. If you die after the selected 10-year guarantee period, nothing is payable.

Transitioning to retirement with annuities

- With a fixed product, you know ahead of time how much you’ll receive once the annuitization phase begins—that is, when the insurer starts making payments back to you.

- You may also receive more income by choosing to be paid annually in arrears rather than monthly.

- You can see this by comparing the two present value formulas below.

- With this rule, a $10,000 distribution from either contract will result in only $5,000 in taxable income.

You need to make sure that the one you buy is the one that best suits your circumstances. As well, a good timeline requires a clear distinction between ordinary annuities and annuities due. END is used to represent ordinary annuities, since payments occur at the end of the payment interval. Similarly, BGN is used to represent annuities due, since payments occur at the beginning of the payment interval. The figure below illustrates the adapted annuity timeline format.

Variable annuity

Usually, the income is initially set up with an ‘emergency tax code’. You can use our online form to compare annuity rates from all providers in the annuity open market. No, a pension fund is something you save into throughout your life, and you can use to help fund your retirement. An annuity can be bought with a pension fund to provide you with a regular guaranteed income.

Leaving money in a deferred annuity can also help reduce your Social Security taxes, as you have less taxable income when you delay withdrawals. Your return is based on the performance of a annuity in advance basket of stock and bond products, called subaccounts, that you select. There’s a bigger opportunity for growth compared with a fixed annuity, but there’s also more risk during recessions.

There are fixed annuities, where the payments are constant, but there are also variable annuities that allow you to accumulate the payments and then invest them on a tax-deferred basis. There are also equity-indexed annuities where payments are linked to an index. FILI is licensed in all states except New York; EFILI is licensed only in New York. A contract’s financial guarantees are subject to the claims-paying ability of the issuing insurance company. A wide range of financial products all involve a series of payments that are equal and are made at fixed intervals. The two conditions that need to be met are constant payments and a fixed number of periods.

If you have a standard single lifetime annuity, with no added options, when you die your income payments will stop. You can, however, add features to your annuity to give you the choice to leave something behind after your death. If you are receiving annuity income, an annuity due is preferred because you get the money sooner. Assuming monthly payments, an annuity due puts the cash in your hands one month earlier vs. an ordinary annuity. Annuities are further differentiated depending on the variability of their cash flows. There are fixed annuities, where the payments are equal, but also variable annuities, that you allow to accumulate and then invest based on several, tax-deferred options.

The payment for an annuity due is made at the beginning of each period. This variance in when the payments are made results in different present and future value calculations. This can be particularly important when making financial decisions, such as whether to take a lump sum payment from a pension plan or to receive a series of payments from an annuity. You will usually receive a higher annuity income if you choose to take your annuity payments in arrears, rather than in advance.

It always comes first and begins after an initial investment is made. There are several ways this can be accomplished; the most common method is to transfer funds, usually by check or bank transfer. Funds can come in the form of one lump sum or a series of payments, and there is precise reasoning for both methods. A lump sum is more commonly chosen by investors close to or already in retirement in order to start the annuitization and payout phase as quickly as possible. This allows them to start receiving distributions that are usually guaranteed for life right away. Also called “immediate annuities” because their distribution, or payout, of income is almost immediate, they have very short accumulation phases as a result.

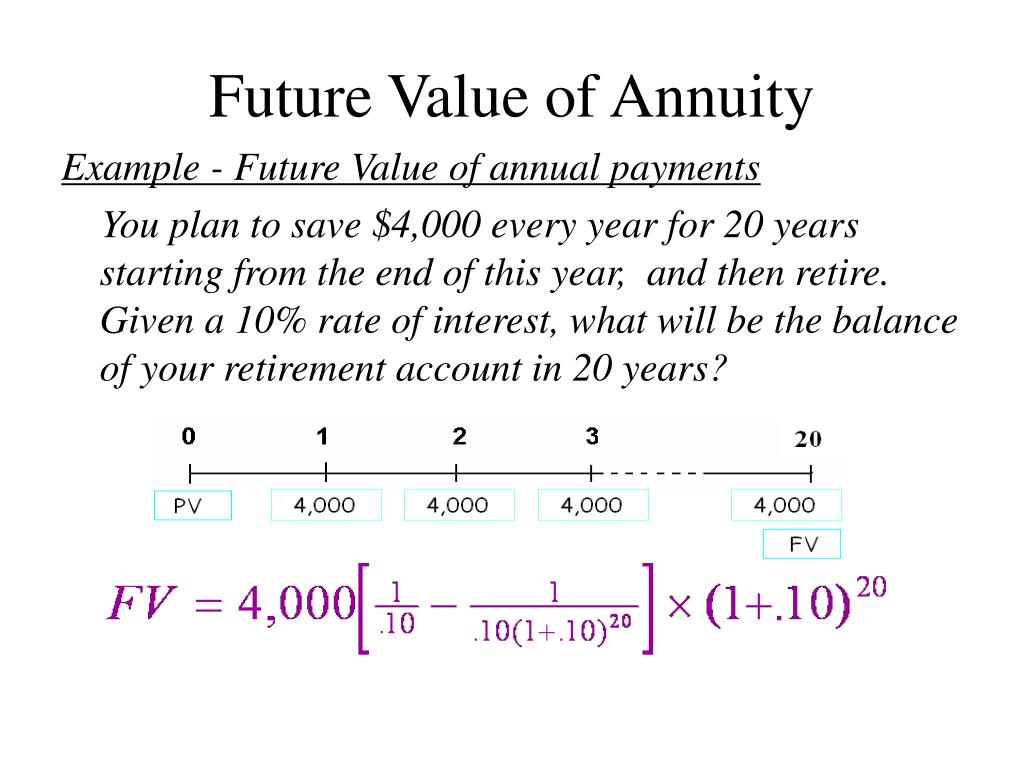

Besides, other factors that need to be taken into consideration may appear and complicate the estimation even further. In the following section, you can learn how to apply our future value annuity calculator to any scenario, no matter how complex. The most important way to differentiate annuities from the view of the present calculator is the timing of the payments.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. First, we will calculate the present value (PV) of the annuity given the assumptions regarding the bond. In our illustrative example, we’ll calculate an annuity’s present value (PV) under two different scenarios. When calculating the present value (PV) of an annuity, one factor to consider is the timing of the payment. Earlier cash flows can be reinvested earlier and for a longer duration, so these cash flows carry the highest value (and vice versa for cash flows received later).