Percentage of sales method: What it is and how to calculate

It’s a quicker method because of its simplicity, so some businesses prefer it to other, more complex techniques. The best part of this method is it doesn’t need loads of data to work, just the prior sales and a calculator (or software, if you want to make life easier). That’s what we’ll cover in this guide to the percentage-of-sales method. Arm your business with the tools you need to boost your income with our interactive profit margin calculator and guide. We’ll walk through an example with a positive net income, but we will also point out spots where problems could occur and lead to a negative net income.

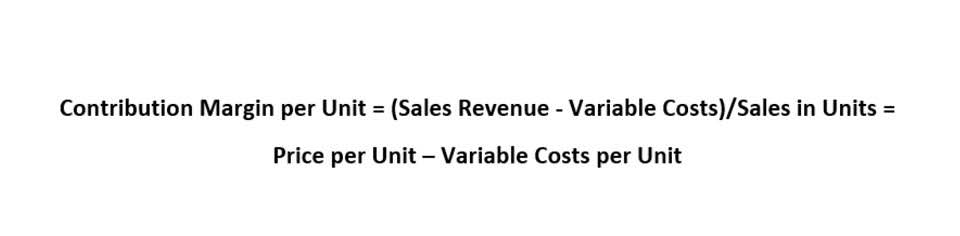

How to calculate step by step

Before you start panicking and planning for a ton of debt, it’s important you know which method you should use to determine your allowance for bad debt. Each method is useful for different reasons, so read the following sections carefully to determine which one fits your ship the best. First, it is a quick and easy way to develop a forecast within a short period of time. And second, it can yield high-quality forecasts for those items that closely correlate with sales. This takes the credit sales method a step further by calculating roughly how much a company can expect not to be paid back from customers if they haven’t paid their credit sales after 90 days.

Learn to Use the Percentage of Sales Method to Improve Your Forecasting

- Well, one of the more popular, efficient ways to approach the situation would be to employ something known as the percent of sales method.

- The clouds are blocking your view and you have no idea where you’re headed.

- Profitability ratios, for example, are an excellent tool for a more detailed and accurate financial forecast.

- We offer self-paced programs (with weekly deadlines) on the HBS Online course platform.

- She estimates that approximately 2 percent of her credit sales may come back faulty.

Unfortunately for various reasons, some accounts receivable will remain unpaid and will need to be provided for in the accounting records of the business. While the PoC revenue recognition method can be extremely beneficial for many organizations, it’s not without its limitations. As mentioned, in order for the method to be successful, the company must be able to estimate revenues, costs, and the total length of time of the project. If your business model is prone to wild fluctuations in materials costs, or your projects frequently run well beyond estimations, it may be better to stick with a more definitive revenue recognition method. If other revenue recognition methods, such as the sales-based and completed-contract methods, offer relative simplicity in terms of recording income, then why would someone prefer to use PoC? Although it may be slightly more complicated, there are several advantages to using PoC for certain companies.

What is white space analysis? The ultimate guide to addressing unmet customer needs

- Add these together to get $42,000 in total credit sales in the past three years.

- For the sake of example, let’s imagine a hypothetical businessperson, Barbara Bunsen.

- Consider enrolling in Financial Accounting—one of three courses comprising our Credential of Readiness (CORe) program—to learn how to use financial principles to inform business decisions.

- He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- For example, if the historical cost of goods sold as a percentage of sales has been 42%, then the same percentage is applied to the forecasted sales level.

We’ll go through each step and then walk through an example to see the formula in action. Most businesses think they have a good sense of whether sales are up or down, but how are they gauging accuracy? With shifting budgets and different departments needing more or less from the company every month, having a precise account of every expense and how it percentage of sales method accounting relates to future sales is a must. By no means is meant to be hailed as a definitive document of every aspect of your company’s financial future. If you want a clearer, more accurate picture of where your company is headed financially, you’re better off carefully detailed, line-by-line forecast that considers other aspects beyond your sales level.

We’ll also show you a real-life example, highlighting its benefits and drawbacks. It is determined by adding to $0 any additions to the allowance account during the year, then adding to that total any write-offs of Accounts Receivable during the year. And if there are no additions or write-offs, the balance in the account is zero. Our easy online application is free, and no special documentation is required. All participants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. Our easy online enrollment form is free, and no special documentation is required.

Learn more about Salesforce CPQ

- If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice.

- Set your accounts receivable team up for success so they can invoice quickly and accurately, and collect promptly upon completion.

- If other revenue recognition methods, such as the sales-based and completed-contract methods, offer relative simplicity in terms of recording income, then why would someone prefer to use PoC?

- For example, if you forecast high-level trends for general planning purposes, you can rely more on broad assumptions than specific details.

- Learn how to use the sales revenue formula so you can gauge your company’s continued viability and forecast more accurately.

Just like weather forecasters sometimes get it wrong, the percentage of sales method also has limitations. Determine the balances of the line items and calculate their percentages relative to your sales. Following a few simple steps, you can forecast future revenues and expenses to ensure your business stays on track. It lets you look at past sales to make smart predictions for the future. The allowance method is a technique for estimating and recording of uncollectible amounts when a customer fails to pay, and is the preferred alternative to the direct write-off method.

Important Formulas Used in PoC Calculations